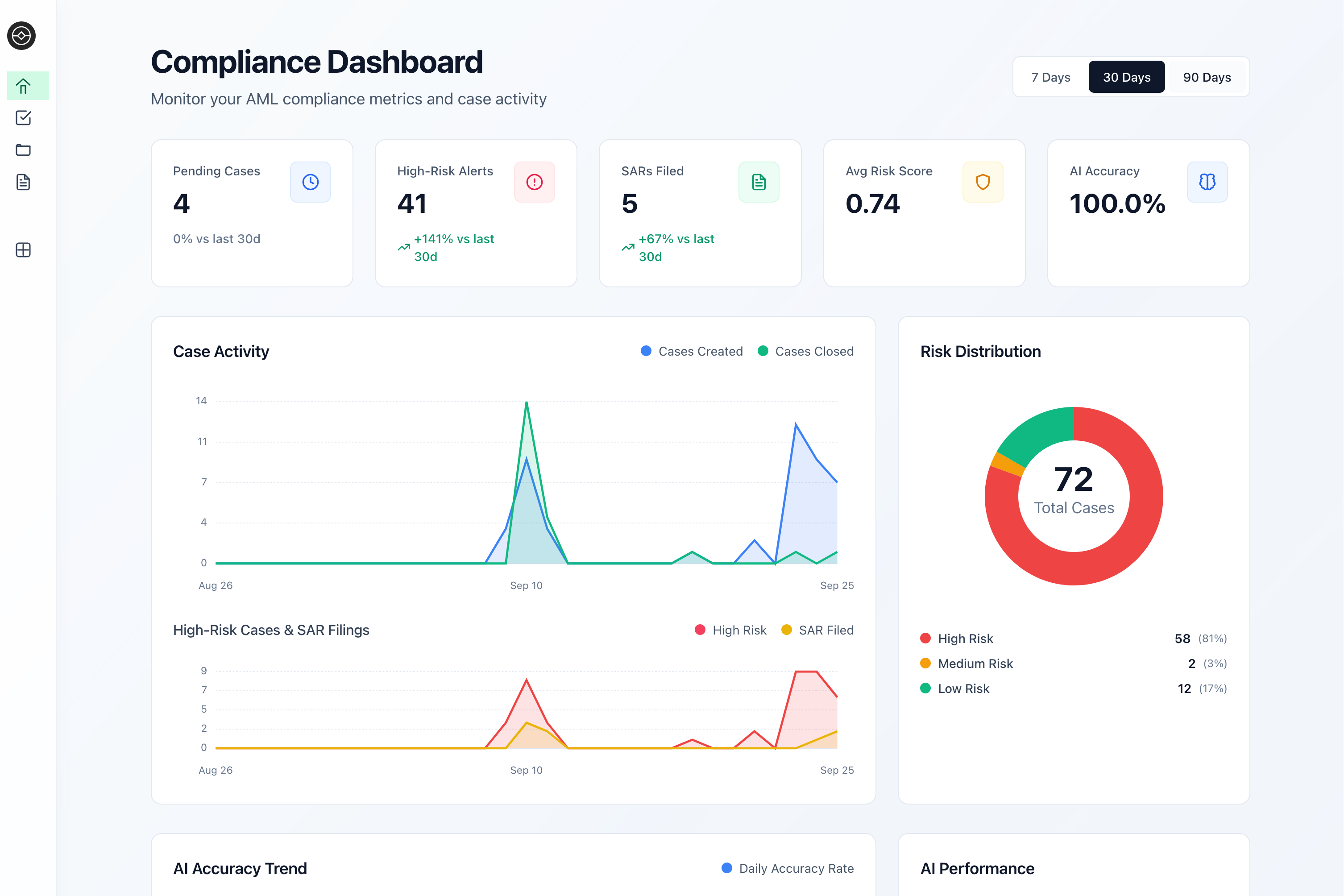

Agentic AI for AML compliance

Streamline your AML compliance with intelligent automation, real-time monitoring, and actionable insights that keep you ahead of regulatory requirements.

Handle 3 x the Work

With the same team, achieve unprecedented productivity through intelligent automation and streamlined workflows that scale with your business.

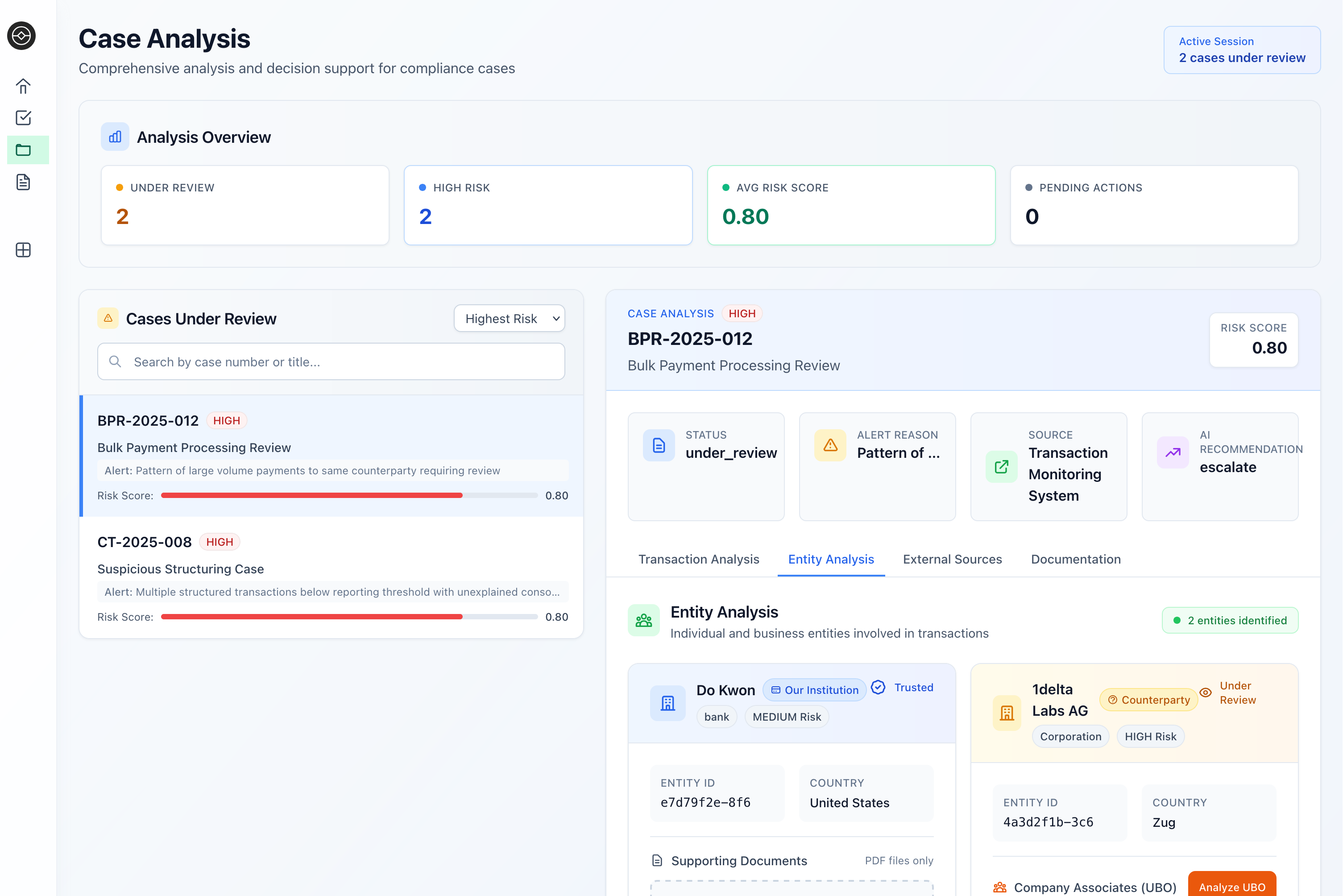

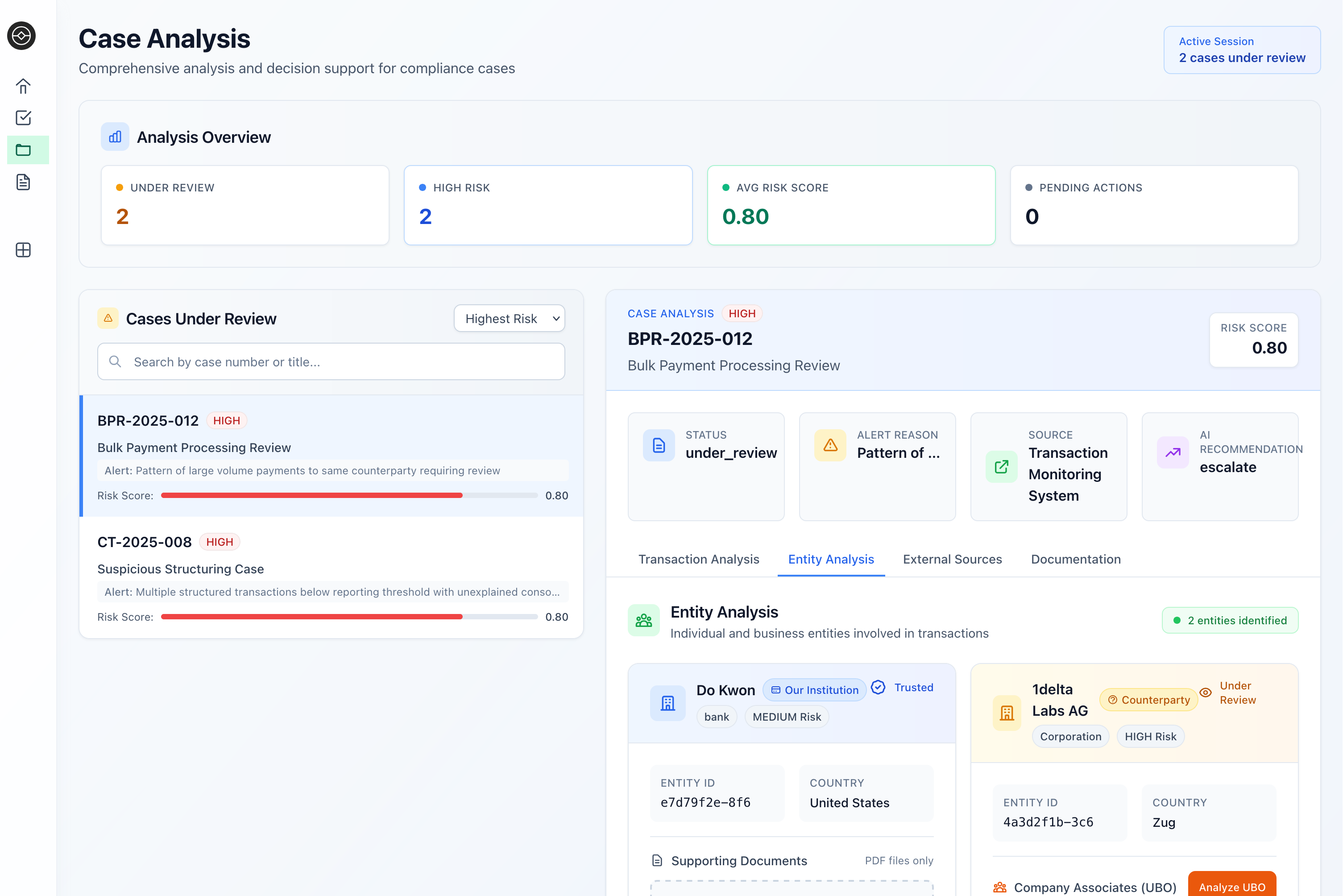

Intelligent Case Analysis

AI-powered case analysis that automatically identifies patterns, risks, and compliance issues with unprecedented accuracy.

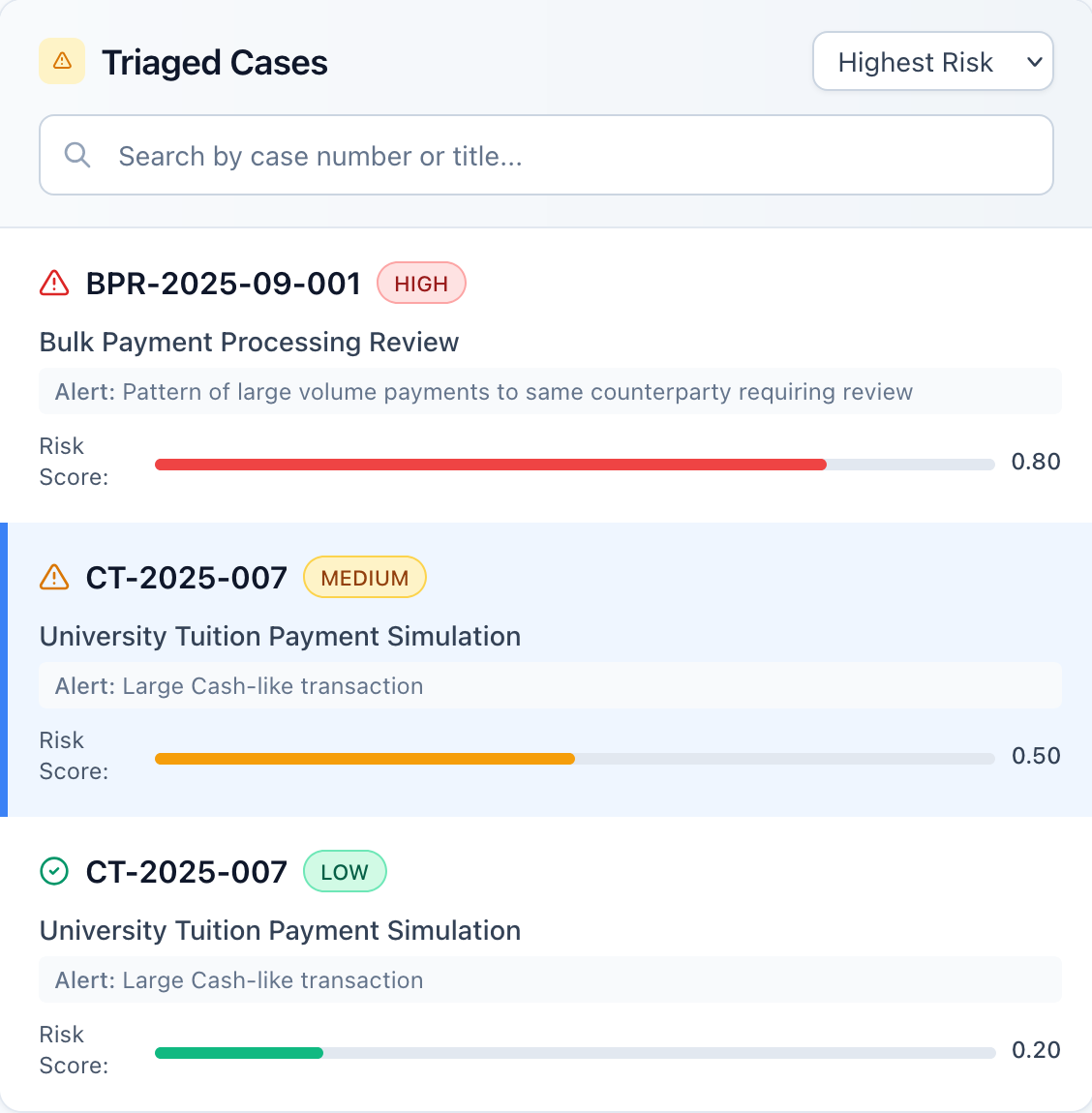

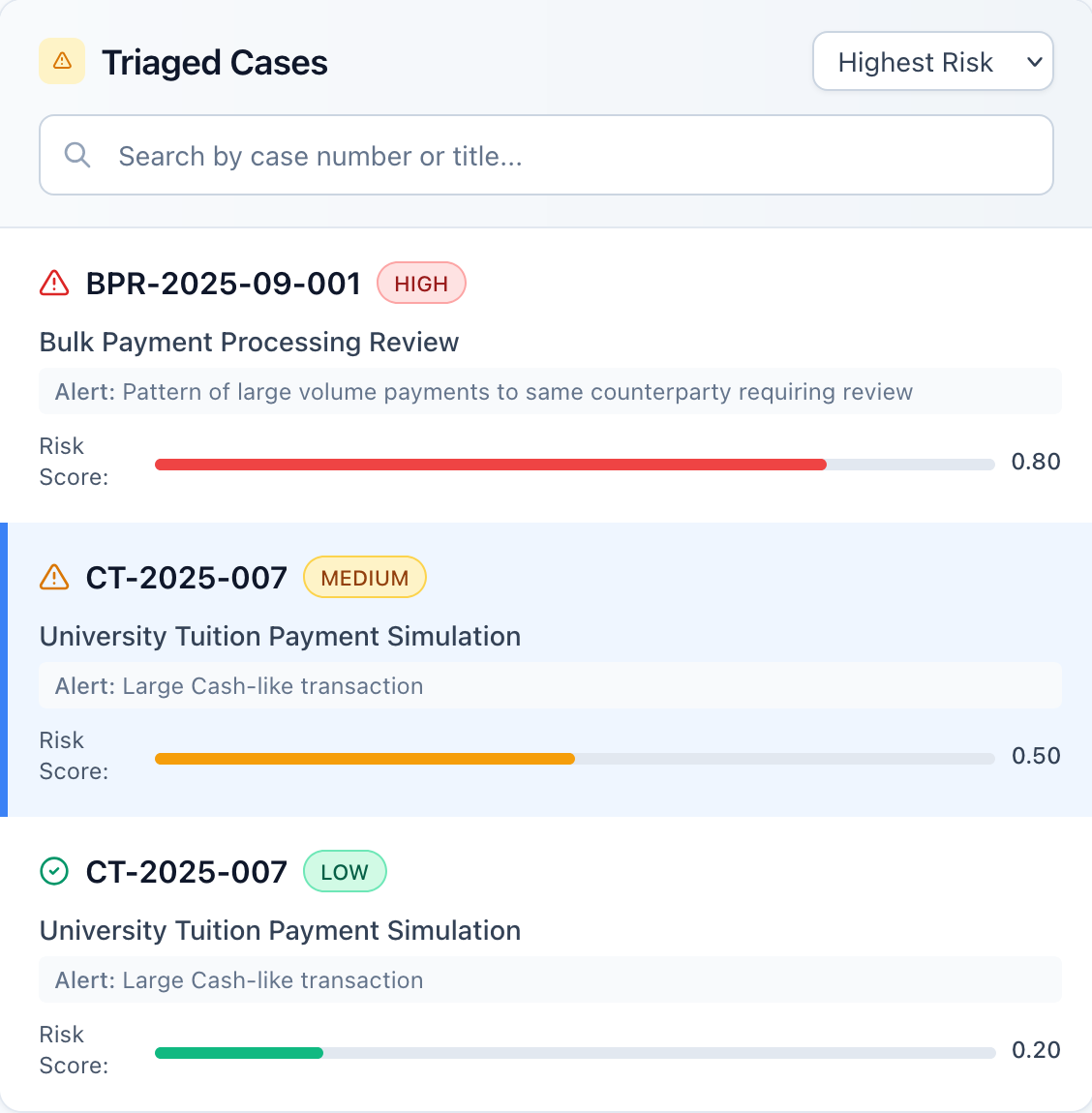

Smart Case Triage

Intelligent case prioritization and routing with automatic categorization and assignment.

Automated SAR Reporting

Generate comprehensive SAR reports automatically with AI-powered analysis.

Complete Audit Trail

Maintain detailed audit trails with full case history and decision tracking.

Seamlessly Integrate with Existing Tools

Our platform integrates seamlessly with your existing toolsets and workflows, ensuring a smooth transition without disrupting your current operations.

Automate the Tedious, Focus on Risk

Let AI handle the manual compliance work so your team can focus on what matters most: identifying and mitigating real risks.

Auto-Close Low Risk Alerts

Automatically closes 60-80% of low-risk alerts with documented rationale, reducing manual review time by 70%.

SAR Generation in Minutes

Generates complete SAR narratives with source citations and exports to XML format, reducing SAR creation from 3-5 days to 30-40 minutes.

Sanctions List Screening

Real-time screening against 50+ global sanctions lists with automatic hit detection and source attribution.

UBO Identification

Automatically identifies Ultimate Beneficial Owners through corporate registry searches and ownership chain analysis.

Transaction Pattern Detection

Detects suspicious transaction patterns including structuring, layering, and unusual activity.

Negative News Monitoring

Scans 10,000+ news sources daily for adverse media mentions with automatic case enrichment and risk scoring.

Regulatory Report Export

Exports SARs/STRs in XML format compliant with FinCEN, FCA, and other regulatory requirements.

AI Research Engine

Advanced AI algorithms analyze entities, research complex case patterns, and evolve detection strategies through continuous learning and adaptation.

Case Processing Time

Reduces average case processing time from 2-4 hours to 15-20 minutes through automated analysis and documentation.

Multi-Jurisdiction Compliance

Supports compliance across multiple jurisdictions with localized regulatory requirements and reporting formats.

Audit Trail Generation

Creates complete audit trails with decision rationale, source documents, and analyst notes for regulatory examinations.

API Integration

Integrates with banking systems, core banking platforms, and compliance tools via REST APIs.